The Draft Regulation of the Turkish Emissions Trading System Has Been Published!

- Goldstein Carbon

- Jul 25, 2025

- 2 min read

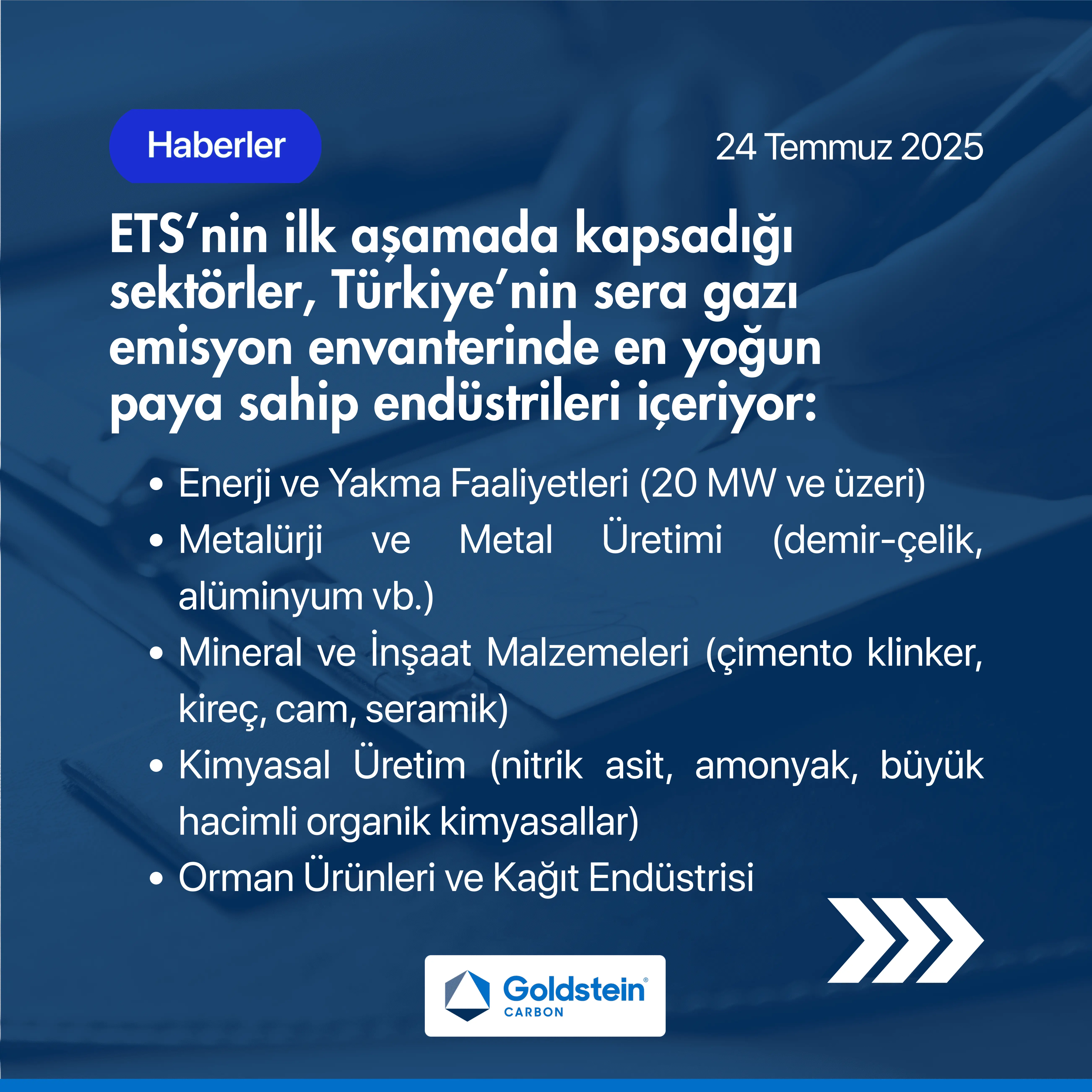

The first draft of the Emissions Trading System (ETS) regulation has been published, marking a major milestone in Türkiye’s climate policy. This system introduces carbon pricing to encourage greenhouse gas (GHG) emission reductions and establishes a new market mechanism to accelerate the green transition. It includes components such as permitting procedures, allocation management, primary and secondary market operations, market stability, and the use of voluntary carbon credits.

According to the regulation, GHG emission permits are valid for five years from their effective date. Companies must apply for renewal at least six months before the expiration and obtain a new permit before the five-year period ends.

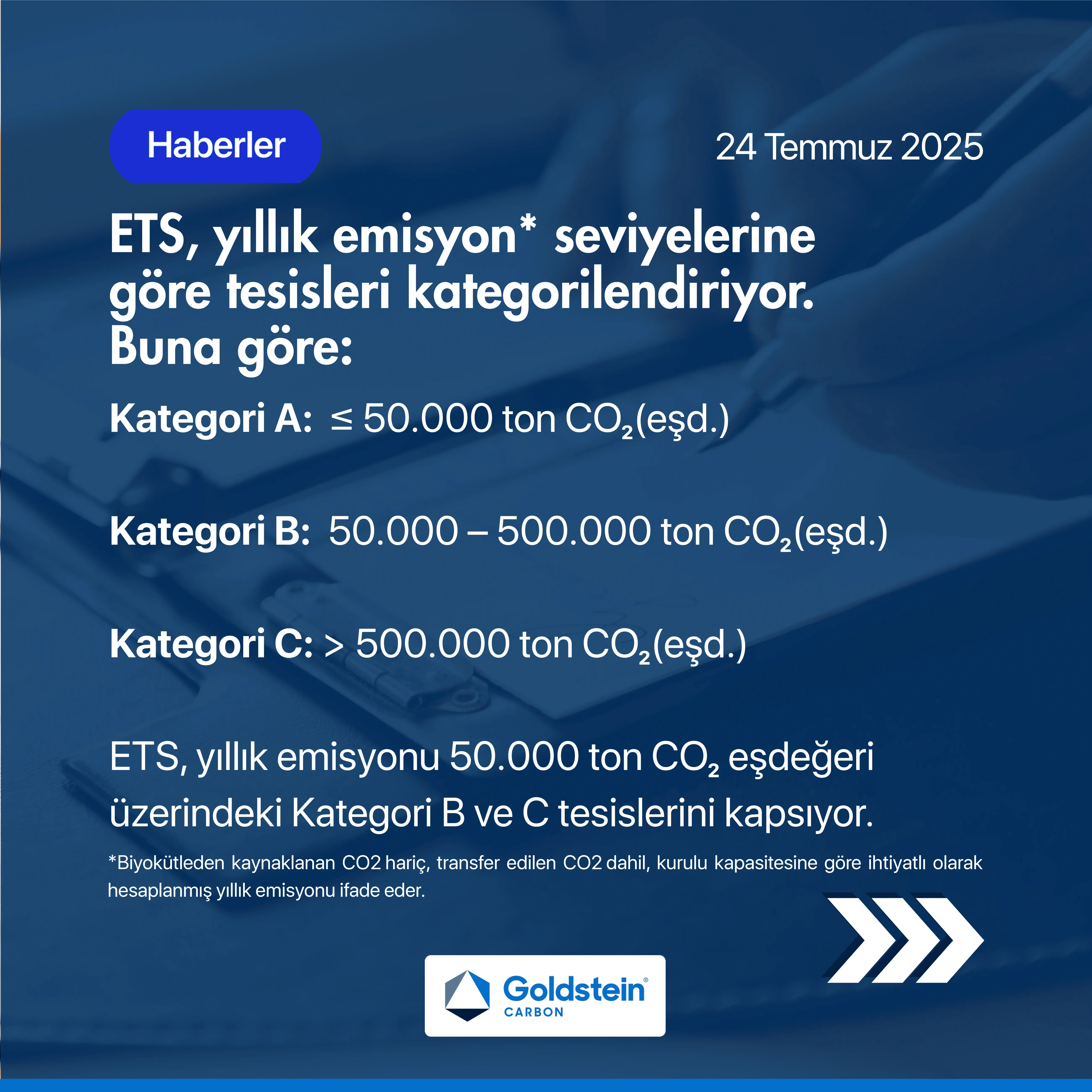

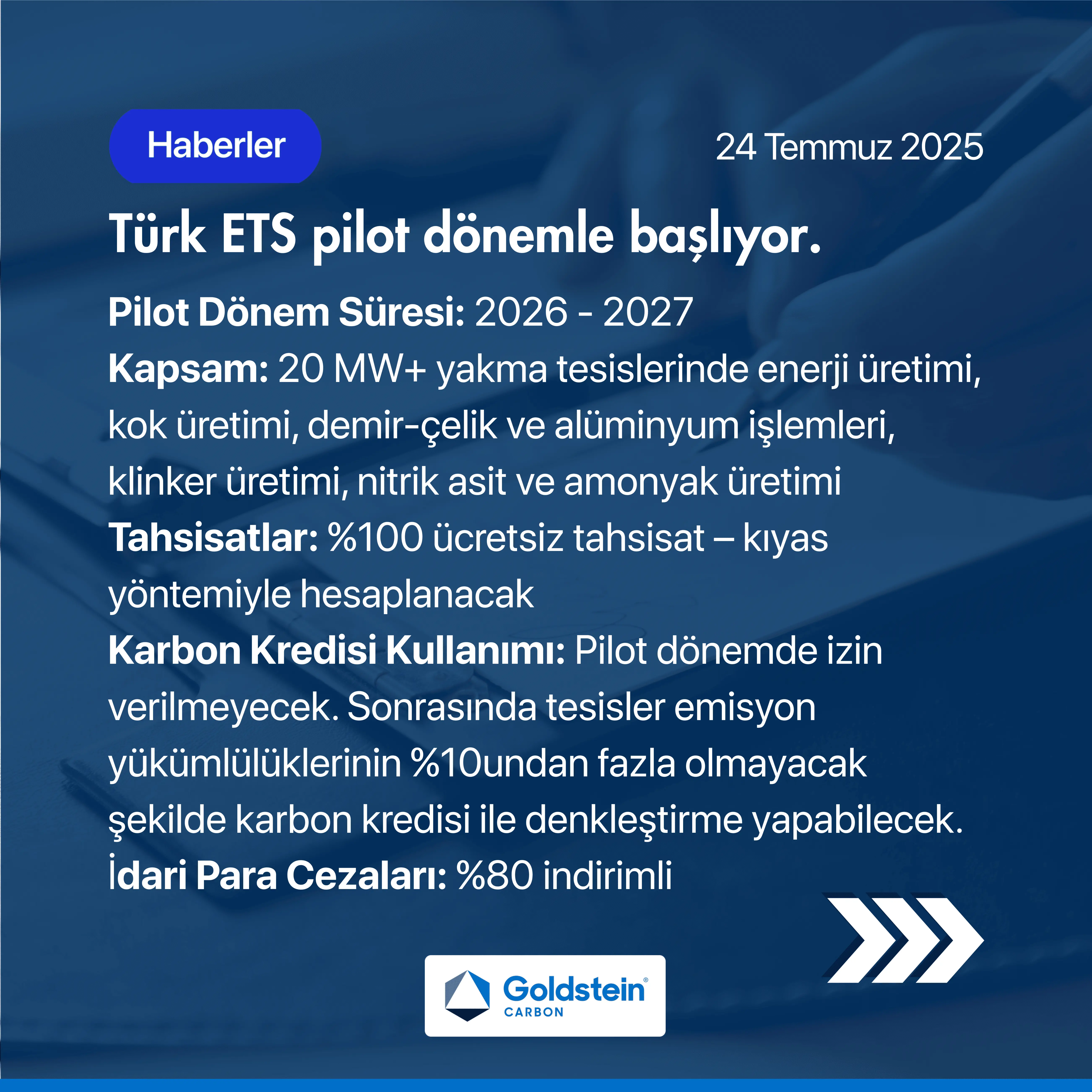

The ETS applies a cap determined based on emission intensity. Allowances under this cap are issued through the Registry, and may either be auctioned in the primary market or distributed free of charge based on set ratios. The allocation procedures will be further detailed in secondary regulations to be published by the Energy Market Regulatory Authority (EPDK).

Companies must fulfill their compliance obligations by the last business day of November each year, based on verified facility-level emission reports. If a facility cannot meet its obligation, a supplementary reserve mechanism may be triggered under specific conditions. This reserve may only be used for compliance purposes and cannot exceed ten percent of the national ETS cap. If a facility received more than 70% of its allowances for free, all of them must be surrendered. If it received less than 70%, at least 70% of its obligation must be fulfilled and the account must be empty to access the reserve. For example, if a company reports 100,000 tons of emissions and 75% is covered by free allocation, it must first surrender all of those to use the reserve.

After the National Allocation Plan is published, allowances are auctioned in the primary market within 15 business days according to a published auction calendar. The secondary market operates continuously, where participants can sell surplus allowances or buy to cover shortfalls. For example, a facility may sell excess allowances in the secondary market for revenue, while another may purchase them to meet its compliance obligation.

A market stability mechanism is also introduced. Through the Market Stability Reserve, adjustments in the primary market will ensure balance based on circulating supply and pricing evaluations. Banking and borrowing mechanisms will also be permitted to enhance market flexibility.

Additionally, voluntary carbon credits from certified carbon projects will be integrated into the system. Facilities will be able to use these credits for up to ten percent of their ETS compliance obligation. This provides operational flexibility while encouraging local carbon reduction projects. For instance, a facility with 200,000 tons of emissions may use 20,000 tons worth of voluntary credits from local renewable energy or energy efficiency projects. This both supports domestic carbon markets and helps operators comply cost-effectively.

At Goldstein Carbon, we prioritize guiding companies through this transformation, ensuring clear understanding and compliance. For expert support on ETS obligations, market strategies, and effective voluntary credit use, you can always contact us and consult our team.

Comments